Data encoding on cards

Encoding involves adding data other than visual information to ID cards by integrating it onto a magnetic stripe or chip.

Why use data encoding?

Increased storage capacity: encoding makes it possible to integrate a large amount of data in cards, thus extending their field of application. The small surface area of the card format does not affect the amount of data contained in the badge.

Easy to update: magnetic stripes and chips can be reprogrammed if information needs to be added, deleted, or amended. This flexibility makes it possible to keep using cards that would otherwise have been obsolete without encoding.

Enhanced card security: encoded data on cards becomes invisible and a special device is needed to read the data. This is the first level of security. Ensuring that data is secure depends on the encryption used during encoding.

Process automation: encoded cards are read automatically by special devices with limited human intervention.

What are the various encoding technologies?

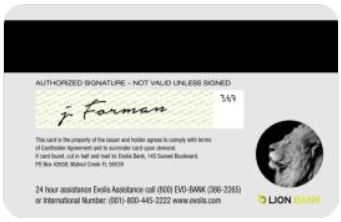

Encoding on magnetic stripe:

Data is recorded on the stripe (black or brown) on the back of the plastic card. Resistance to damage caused by external magnetic fields varies depending on the type of card chosen:

- HiCo (High Coercivity) cards for a high level of resistance

- LoCo (Low Coercivity) cards for low a level of resistance – these cards have the advantage of being less expensive.

Encoding on contact chip:

This microprocessor chip has a storage capacity more than 100 times greater than a magnetic stripe.

Embedded in the card and perfectly visible, this type of chip requires physical contact with the data reader.

Bank cards often use this encoding technology.

Encoding on contactless chip:

Contactless cards integrate several components:

- A chip with a radiofrequency transmitter

- An antenna

- A plastic base

The contactless smartcard does not come into contact with the reader: it communicates using radio waves, with the distance varying depending on the technology used. Data encoding on contactless chips is frequently used for employee badges and transport cards.

Data encoding systems

Each of these technologies requires specific encoders to “read” and/or “write” the data.

These encoders are available either:

- as standard on some card printer models,

- as single modules to be integrated into the card printing system. Ensuring that the printer can accommodate them is therefore essential.

Different encoding technologies can be combined to create more sophisticated and more secure cards. For example, you can have payment cards that include both a magnetic stripe and a contact or contactless chip.